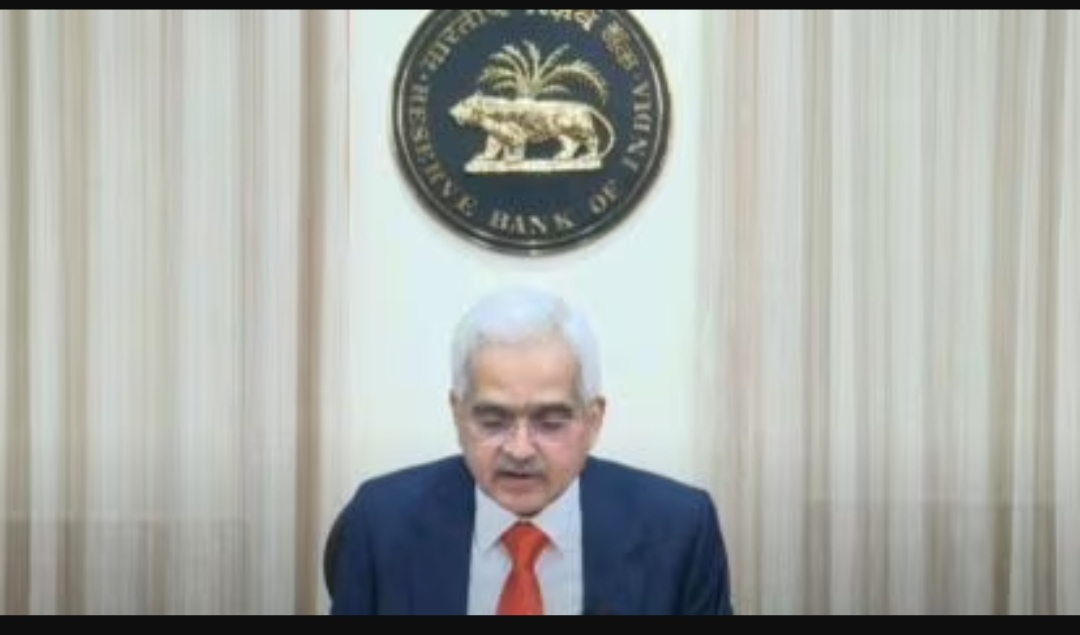

RBI Governor Shaktikanta Das announced the monetary policy statement on Friday.

The Monetary Policy Committee (MPC) of the Reserve Bank of India on Friday decided to keep the repo rate unchanged at 6.50 per cent for the fifth consecutive time. Governor Shaktikanta Das said the growth forecast has been raised to 7 per cent for the current financial year from 6.5 per cent previously.

“Monetary policy will remain aggressively disinflationary,” Das said while announcing the central bank’s monetary policy statement. He added that the vote on the pension rate decision was unanimous. Repo rate is the interest rate at which the RBI lends money to commercial banks.

GDP growth

Growth forecast was raised to 7% for the current financial year from 6.5% previously.

The central bank has forecast retail price inflation based on consumer price inflation (CPI) at 5.4% for the current financial year.

India’s economy grew 7.6% in the July-September quarter, much faster than the poll average of 6.8% and the RBI’s estimate of 6.5%, thanks to spending government spending and the manufacturing sector, leading to expectations that Asia’s third-largest economy will surpass its current one. Separate estimates for the quarter whole year.

The Governor said the RBI forecasts retail inflation at 5.4 per cent in FY24. “As 2023 comes to a close, the global economy is showing signs of slowing,” he said. The RBI has raised the repo rate by a total of 250 basis points (bps) from May 2022 in a bid to rein in soaring inflation, which fell to a four-month low of 4.87% in October, but still higher than RBI’s level of 4. %. medium-term goals over a period of time.

The RBI also maintained a policy of “withdrawal of accommodative measures” to ensure inflation is gradually in line with the committee’s target while supporting economic growth.

The MPC meeting took place in the context of inflation falling to 4.87% in October. November inflation figures are expected to be announced next week. Nifty, Sensex hold gains after MPC keeps interest rates unchanged.

Stocks maintained gains on Friday, Reuters reported, with benchmark indexes Nifty 50 and Sensex hitting fresh record highs following the RBI announcement.

The NSE Nifty 50 index was up 0.37 per cent at 20,976.70 points, while the S&P BSE Sensex was up 0.36 per cent at 69,770.14 at 10:10 am IST.

According to the press release, domestic economic activity is maintaining well while the risk of food inflation remains. “The Indian economy presents a picture of resilience and dynamism; Fundamentals remain strong,” the RBI governor said.

“Today’s announcement to keep the repo rate unchanged comes at a time when inflation, although showing signs of slowing, remains a persistent problem. Crude oil prices are showing signs of slowing down and could help bring global economic stability. Therefore, the possibility of the central bank reducing interest rates can be considered. Adhil Shetty, CEO, BankBazaar.com, said today’s announcement to maintain the policy rate moratorium will further provide relief to borrowers, especially with regard to governance debt and household spending.

For more information visit at https://happenrecently.com/zepto/?amp=1