The global economy is bracing for a challenging year in 2023 as the world’s three largest economic engines — the United States, Europe, and China — experience a rare, simultaneous slowdown, according to the International Monetary Fund (IMF).

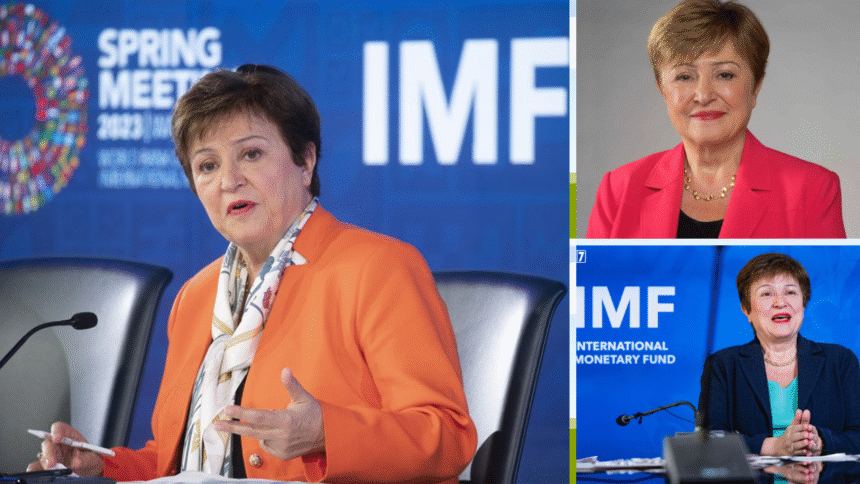

IMF Managing Director Kristalina Georgieva delivered the sobering forecast during an appearance on CBS’s Face the Nation on Sunday, cautioning that the slowdown will affect billions worldwide and that even nations avoiding outright recession will face recession-like conditions for their citizens.

“The new year is going to be tougher than the year we leave behind,” Georgieva stated. “Why? Because the three big economies – the US, EU, and China – are all slowing down simultaneously.”

Global Recession Risks at Historic Highs

The IMF projects that one-third of the global economy will enter a recession in 2023, marking one of the most synchronized global slowdowns in decades. This downturn, the IMF warns, will not be confined to a handful of nations — its ripple effects will be felt worldwide.

Even countries that technically avoid recession — defined as two consecutive quarters of negative growth — are likely to face stagnating wages, rising unemployment, and reduced consumer confidence. “For hundreds of millions of people, it will feel like a recession,” Georgieva emphasized.

Drivers of the Global Slowdown

- United States:

The U.S. economy, which accounts for nearly a quarter of global GDP, faces a cooling labor market and reduced consumer spending power. Rising interest rates — part of the Federal Reserve’s aggressive monetary tightening to curb inflation — have slowed borrowing and investment. While the U.S. may avoid a deep recession, growth is expected to remain sluggish, limiting its role as a driver of global demand. - Europe:

The European Union is contending with the twin challenges of high inflation and energy supply disruptions caused by the ongoing geopolitical crisis in Ukraine. The resulting cost-of-living crisis has weakened household purchasing power, while higher borrowing costs have dampened business investment. Several key economies, including Germany and Italy, are already teetering on the brink of contraction. - China:

Once the fastest-growing major economy, China is grappling with the lingering economic fallout from its prolonged COVID-19 restrictions, a cooling property market, and weaker export demand. While recent policy adjustments have been aimed at reviving growth, the IMF anticipates that China’s slowdown will contribute significantly to the broader global downturn.

Impact on Emerging and Developing Economies

The IMF cautions that emerging markets and developing economies will face disproportionate hardships. Weaker demand from advanced economies will reduce export revenues, while higher global interest rates will make debt servicing more expensive for nations with significant foreign borrowing.

Furthermore, the combination of strong U.S. dollar performance and tighter global financial conditions will increase capital outflow pressures on vulnerable economies, potentially leading to currency depreciation and inflationary spikes.

Policy Recommendations from the IMF

Georgieva underscored the importance of coordinated policy action to mitigate the severity of the downturn. The IMF’s recommendations include:

- Monetary Policy Discipline: Central banks should continue efforts to bring inflation under control, but remain cautious to avoid overtightening that could deepen the slowdown.

- Targeted Fiscal Support: Governments should focus on protecting the most vulnerable households while avoiding blanket stimulus measures that could fuel inflation.

- Structural Reforms: Long-term measures to improve productivity, diversify economies, and strengthen energy security will be critical to building resilience.

- International Cooperation: Given the interconnected nature of the slowdown, countries should work together to maintain open trade flows and avoid protectionist measures.

A Call for Resilience and Preparedness

While the outlook is challenging, Georgieva stressed that the situation is not without hope. Countries that act decisively to stabilize their economies and support vulnerable populations can weather the storm and emerge stronger.

“We have been through global crises before — from the financial collapse of 2008 to the COVID-19 pandemic — and each time, coordinated global action made recovery possible,” she said. “The same spirit of resilience and cooperation will be needed again.”

Looking Beyond 2023

The IMF anticipates that global growth could begin to recover in 2024, provided inflation is brought under control and geopolitical tensions do not escalate further. Structural shifts, such as the acceleration of green energy investments and digital transformation, could also provide new growth opportunities if governments act strategically.

However, Georgieva warned that the current slowdown serves as a stark reminder of the global economy’s vulnerabilities. “We must not only manage this downturn but also take the necessary steps to build a more shock-resistant global economy for the future,” she said.