In a landmark development for India’s fintech sector, Chinese fintech giant Ant Financial, an affiliate of Alibaba Group’s Ant Group, has fully divested its stake in One97 Communications Ltd, the parent company of Paytm. The exit marks a significant shift in the ownership structure, making Paytm a fully Indian-owned enterprise.

According to bulk deal data released by the Bombay Stock Exchange (BSE), Antfin (Netherlands) Holding BV, a subsidiary of Ant Group, sold its entire 5.84% stake—equivalent to approximately 3.73 crore equity shares—through open market transactions on Tuesday, August 12, 2025.

The shares were sold in two tranches at prices ranging from ₹1,067.53 to ₹1,067.63 per share, fetching a total of ₹3,980.76 crore.

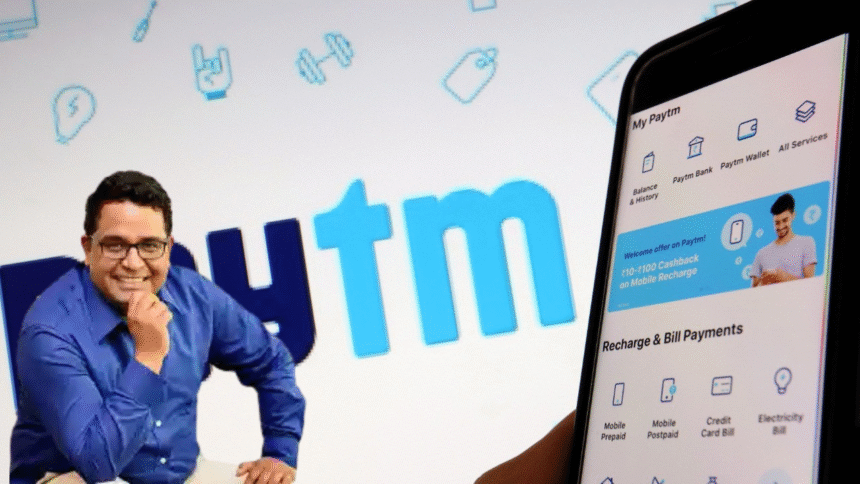

Milestone Moment for Paytm and Indian Fintech With this transaction, Paytm, led by founder and CEO Vijay Shekhar Sharma, is now entirely owned by Indian shareholders. This development is expected to strengthen Paytm’s positioning as a homegrown leader in the digital payments and financial services industry.

“This marks a new chapter in Paytm’s journey. We are proud to be a fully Indian-owned company, continuing our mission of driving financial inclusion, supporting the government’s Digital India vision, and building innovative products for our customers and merchants.”

Vijay Shekhar Sharma, who founded Paytm in 2010, has been at the forefront of India’s digital payments revolution. Under his leadership, the company has grown from a mobile recharge platform into one of India’s most prominent fintech players, offering a diverse portfolio of services, including payments, banking, lending, insurance, and wealth management.

From Foreign Backing to Full Indian Ownership

Ant Group, formerly known as Ant Financial, became one of Paytm’s largest early backers during its growth phase, providing crucial funding and strategic support as the company scaled rapidly across India. Over the years, Paytm also attracted investments from other global investors, fueling innovation and expansion.

However, with Ant Group’s complete exit, the ownership profile of Paytm has undergone a fundamental change. As of the June 2025 quarter, Antfin held exactly 5.84% of One97 Communications. With the sale completed, no Chinese ownership remains in the company.

Market analysts believe this shift could strengthen Paytm’s brand positioning among Indian consumers and regulators, particularly at a time when domestic ownership and self-reliance in strategic sectors are being emphasized.

The sale price represents a fair market value transaction based on prevailing market rates, indicating stable investor demand for Paytm’s shares despite increased competition in India’s fintech sector.

Industry Context

India’s fintech sector has been undergoing rapid transformation, driven by smartphone penetration, the Unified Payments Interface (UPI), and growing adoption of digital financial services. Paytm has been a key player in shaping this ecosystem, with a merchant network spread across urban and rural India and a suite of consumer-facing financial products.

In recent years, the government has also encouraged reduced dependence on foreign ownership in critical technology and financial infrastructure. The full Indian ownership of Paytm aligns with these policy directions and could pave the way for deeper collaborations with public institutions, state governments, and domestic enterprises.

Industry watchers expect that with its new ownership structure, Paytm will have greater strategic flexibility to pursue domestic partnerships, enhance its merchant base, and expand financial inclusion efforts.

A senior market analyst at a leading brokerage firm commented:

“This is more than a shareholder change—it’s a strategic repositioning. Being fully Indian-owned can help Paytm align more closely with national policy priorities while continuing to innovate in a highly competitive market.”

Paytm has recently been focusing on strengthening its profitability metrics, streamlining operations, and scaling high-margin financial services. Its lending partnerships, Paytm Payment Bank operations, and wealth management services are expected to be key growth drivers in the coming years.