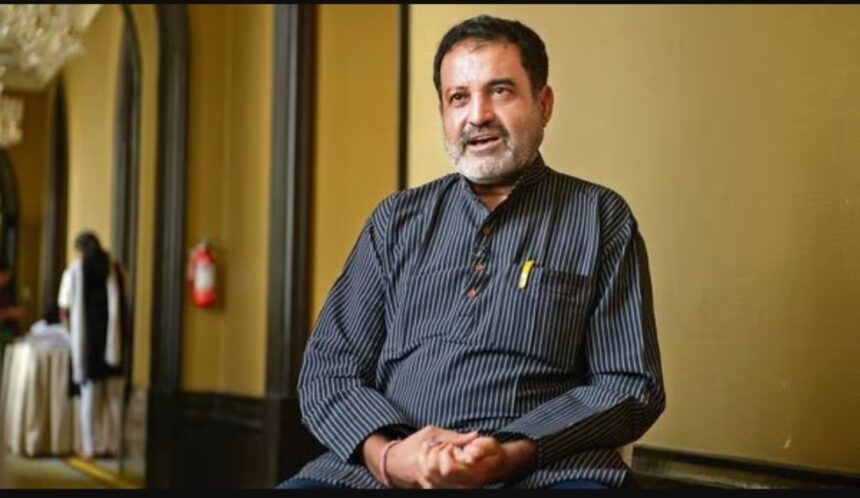

2023 saw a series of incidents where founders clashed on the board of directors, putting corporate governance standards in the spotlight. Byju Raveendran of Byju’s, Ashneer Grover of Bharatpe and Housing.com founder Rahul Yadav (in his new startup avatar), were all in the news when it came to issues related to their style of functioning. TV Mohandas Pai, former Infosys board member and co-founder of Aarin Capital Partners, talks about the importance of having a high-quality board with capable independent directors who have can guide and promote a startup. Mohandas Pai, who is on Byju’s advisory board, declined to talk specifically about the edtech company. Excerpt from an interview:

Superstar founders everywhere often cause major headaches for boards of directors. On the other hand, a bloated board can create obstacles for stubborn founders. Recently, many businesses are struggling to find this balance. The board of directors can only function effectively if there is a good chairman. The chairman is the person who manages the board and interacts with management to ensure things run smoothly. It must balance the interests of investors and the interests of managers. The chairman must be an advisor to management and someone who is respected by everyone. This is the only way it will work in a top company.

The board must engage with management and set the rules of engagement. The powers and responsibilities of the board of directors and management must be clearly defined. When you have a superstar and a dynamic CEO who believes he is changing the world, there are bound to be problems. There are very few such people in the world and you need them. But when people like that are at the top, you need a president with great maturity and skills.

Many of India’s leading IT services companies, such as Infosys and Wipro, are role models of high standards of corporate governance in India. Of course, along the way there was an incident called Satyam. However, when it comes to startups, it seems governance standards still have a long way to go. For a listed company, transparency is necessary as it involves third-party money. Therefore we must respect the standards. In many listed companies too, standards are followed only in letter and not in spirit. There are challenges there too, but because they have to report there is a higher level of transparency.

However, in a private company, governance is a matter between investors and management. That’s not the public’s business. Where is the public interest? The public did not invest any money. Therefore, investors must define principles on how to comply with corporate governance issues. And every time a company (startup) plans an IPO, it has to accept greater transparency and a higher level of accountability, because it is injecting public money into the company. Public money can come from a large number of investors. Therefore their behavior must change.

In what way do you suggest this happens?

At least two years before the IPO, they need to ensure they have independent directors and a strong chairman on the board and they cannot all be investor nominees. Candidates will always listen to what the nominator wants. You need to find the people who will do the work and that board needs to work with management to appoint bankers who will work with the accountants to ensure financial accuracy.

When submitting the prospectus, make sure to read it carefully, sign it and approve the resolution. The red herring prospectus should reflect the Board’s views. The Council must take responsibility for this. Now, if a startup wants to IPO in six months and appoint someone as an independent director, what independent knowledge will that person bring? It took a year and a half to understand the business. New entrants 3-4 months before the IPO cannot help.

This is a very valid point. Often these processes are not followed. Some startups grant significant stock options one or two quarters after listing (grants are limited). When a large grant is given to a founder, it should have been discussed 6-9 months ago. My view is that investors in any company that grants significant options to founders for a quarter or two should have this discussion before the IPO. But this is not stated in the prospectus. Suddenly, after a quarter or two, they make stock picks and it becomes a surprise to everyone. That’s a big risk. You cannot suddenly change your mind. The market should have been informed about this. Giving them to later employees is a normal action, but giving them to the founder is not a normal action.

This shows that the Council has no control. This shows that the Council is not up to date. They are not independent. Even SEBI regulations need to be amended to stipulate that any company seeking an IPO must have an independent board of directors as a listed company for at least a year before filing its prospectus. I think this is an urgently needed reform. If you appoint an independent director 2 to 3 months before the IPO, that person will not be able to have control.

For more information visit at https://happenrecently.com/zepto/?amp=1