The RBI’s Monetary Policy Committee( MPC), in its October meeting, projected consumer price indicator- grounded( CPI) affectation at5.4 per cent for 2023- 24, a temperance from 6.7 per cent in 2022- 23.

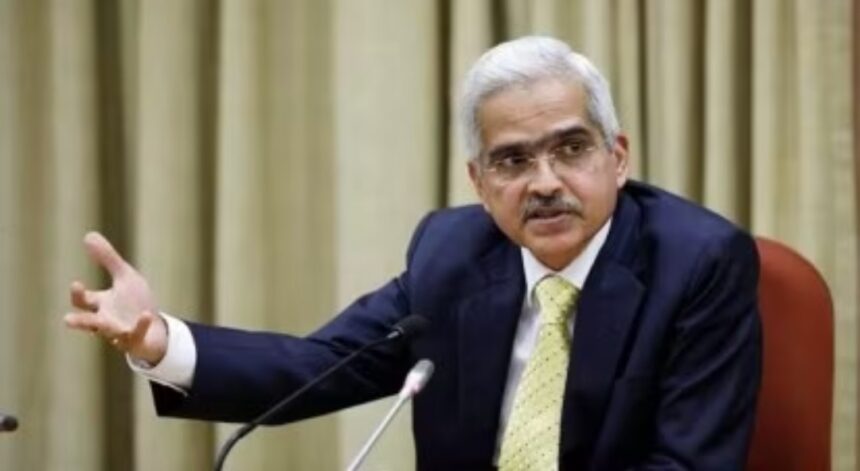

Reserve Bank of India (RBI) Governor Shaktikanta Das Thursday said India remains vulnerable to recreating and lapping food price shocks and that financial policy continues to concentrate on aligning affectation to the 4 per cent target.

The RBI’s Monetary Policy Committee( MPC), in its October meeting, projected consumer price indicator- grounded( CPI) affectation at5.4 per cent for 2023- 24, a temperance from6.7 per cent in 2022- 23.

“ Headline affectation, still, remains vulnerable to recreating and lapping food price shocks. Core affectation has also moderated by 170 base points( bps) since its recent peak in January. In these circumstances, financial policy remains vigilant and laboriously disinflationary to precipitously align affectation to the target, while supporting growth, ” Das said at a council on the Indian frugality in Tokyo, Japan.

One base point is one- hundredth of a chance point. CPI affectation eased to a three- month low of5.02 per cent in September 2023 from6.83 per cent in August. CPI data for October will be released November 13.

Last month, Das had underscored that RBI’s affectation target was 4 per cent and not 2 to 6 per cent. “ Our end is to align affectation to the target on a durable base, while supporting growth, ” he told journalists after publicizing October’s financial policy.

RBI has kept the repo rate unchanged at6.5 per cent over the last four financial policy reviews amid enterprises over affectation. Das said that the recent developments in West Asia have added to the challenges for a global frugality formerly scuffling with the fallout from the epidemic, the war in Ukraine and the unknown tightening of financial policy, “ Policymaking in this script becomes extremely grueling with delicate trade- offs — growth versus affectation; price stability versus fiscal stability; and current emergency versus unborn sustainability. There’s always a threat of doing too little or doing too much, ” he said. The governor said in the current uncertain terrain, it’s stylish to avoid any sense of complacency. “ We remain nimble and continue to fortify our macroeconomic fundamentals and buffers, ” he said.

Last week, the country’s Chief Economic Advisor( CEA), V Anantha Nageswaran, said indeed if the US Federal Reserve raises interest rates further, the RBI’ll not be under any pressure to increase its rates.

India remains vulnerable to recreating, lapping food price shocks RBI Governor India remains vulnerable to recreating, lapping food price shocks RBI Governor The RBI’s Monetary Policy Committee( MPC), in its October meeting, projected consumer price indicator- grounded( CPI) affectation at5.4 per cent for 2023- 24, a temperance from 6.7 per cent in 2022- 23.

RBI Governor Shaktikanta Das Reserve Bank of India( RBI) Governor Shaktikanta Das Thursday said India remains vulnerable to recreating and lapping food price shocks and that financial policy continues to concentrate on aligning affectation to the 4 per cent target. The RBI’s Monetary Policy Committee( MPC), in its October meeting, projected consumer price indicator- grounded( CPI) affectation at5.4 per cent for 2023- 24, a temperance from6.7 per cent in 2022- 23.

“ Headline affectation, still, remains vulnerable to recreating and lapping food price shocks. Core affectation has also moderated by 170 base points( bps) since its recent peak in January. In these circumstances, financial policy remains vigilant and laboriously disinflationary to precipitously align affectation to the target, while supporting growth, ” Das said at a council on the Indian frugality in Tokyo, Japan.

One base point is one- hundredth of a chance point. CPI affectation eased to a three- month low of5.02 per cent in September 2023 from6.83 per cent in August. CPI data for October will be released November 13.

Last month, Das had underscored that RBI’s affectation target was 4 per cent and not 2 to 6 per cent. “ Our end is to align affectation to the target on a durable base, while supporting growth, ” he told journalists after publicizing October’s financial policy.

RBI has kept the repo rate unchanged at6.5 per cent over the last four financial policy reviews amid enterprises over affectation. Das said that the recent developments in West Asia have added to the challenges for a global frugality formerly scuffling with the fallout from the epidemic, the war in Ukraine and the unknown tightening of financial policy, “ Policymaking in this script becomes extremely grueling with delicate trade- offs — growth versus affectation; price stability versus fiscal stability; and current emergency versus unborn sustainability. There’s always a threat of doing too little or doing too much, ” he said. The governor said in the current uncertain terrain, it’s stylish to avoid any sense of complacency. “ We remain nimble and continue to fortify our macroeconomic fundamentals and buffers, ” he said.

Last week, the country’s Chief Economic Advisor( CEA), V Anantha Nageswaran, said indeed if the US Federal Reserve raises interest rates further, the RBI’ll not be under any pressure to increase its rates.

The RBI cycle has not been so tightly linked to the Fed cycle substantially because external finances and fiscal stability are much better now, Nageswaran said in an interview with Bloomberg TV on the sidelines of the Barclays Asia Forum in Singapore.

The US Fed in its financial policy blazoned on November 1, held the interest rates steady at5.25-5.5 per cent range. Fed Chair Jerome Powell said that the US central bank officers are willing to raise rates again if progress on affectation booths. On growth, Das said the country’s GDP grew by7.8 per cent in the first quarter of 2023- 24, and the available high frequence pointers suggest durability of this instigation. Last week, Das said that the alternate quarter GDP number, to be released on November 30, will surprise on the downside. The RBI has projected a real GDP cast of6.5 per cent for financial 2024, with Q2 at6.5 per cent.

The country’s current account deficiency remains manageable and the RBI has bolstered its forex reserves to deal with implicit eventualities, the governor said. As of October 27, the country’s foreign exchange reserves stood at$586.111 billion.

On the fintech space, Das said the arrival of these realities has converted the geography of traditional fiscal services.

He said although fiscal invention enhances ease of payment and lowers its cost, they also pose pitfalls and challenges to the fiscal system, and these pitfalls have a bearing on overall fiscal stability and request integrity.

“ We, thus, intend to play a binary part of acting as protagonist of invention as well as being the controller. While promoting invention, our focus is on icing a well- regulated ecosystem that addresses systemic pitfalls and challenges, ” he said.

For more information visit at https://happenrecently.com/zepto/?amp=1