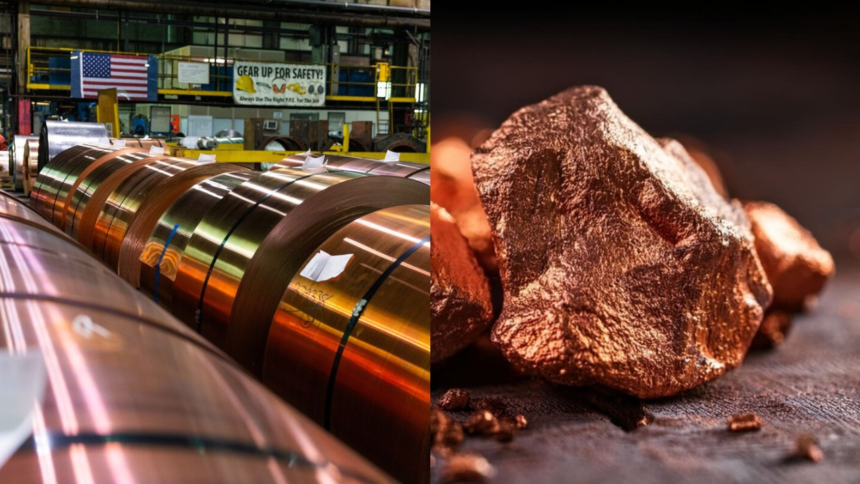

Rising EV adoption, renewable energy expansion, and AI data centre growth are driving unprecedented copper demand worldwide.

In a development that could reshape global industrial plans, experts have warned that the world may face a shortage of nearly 10 million tons of copper by 2040. This looming shortfall has raised alarms across the electric vehicle (EV), renewable energy, and data centre industries — all of which rely heavily on copper as a core raw material.

The warning comes amid rapidly rising demand for copper driven by the twin revolutions of clean energy transition and artificial intelligence (AI) infrastructure expansion. From India’s renewable power targets to global electric mobility goals, copper is emerging as one of the most critical — and potentially constrained — materials of the next two decades.

The Growing Demand for Copper

Copper, sometimes known as “the metal of electrification,” plays an indispensable role in power generation, transmission, and utilization. It is a key component in EV batteries, charging stations, solar panels, wind turbines, and electrical wiring, as well as in emerging data infrastructure such as AI data centres and 5G networks.

According to global market researchers, copper demand is set to grow by more than 50% by 2040, reaching an estimated 35–40 million tons annually compared to the current supply levels of around 25 million tons. This rising demand will primarily be driven by:

- The electrification of transport, as governments push for cleaner mobility and phase out combustion engines.

- The expansion of renewable power projects, especially solar and wind energy, both of which require high copper usage.

- The unprecedented boom in data centres and AI computing, which demand efficient energy systems and reliable power connectivity.

Why the Supply Squeeze Is Concerning

While demand is surging, global copper production and investment in new mines have not kept pace. Extracting and refining copper is a long, capital-intensive process — often taking over a decade from discovery to production. Many existing mines are reaching maturity, with ore grades declining year after year.

Industry leaders worry that without new discoveries, technological innovations, or large-scale recycling initiatives, supply could stagnate even as demand soars. The result, analysts caution, could be a 10-million-ton shortage by 2040 — a gap large enough to disrupt the global energy transition.

Another pressing issue is resource concentration. More than 50% of global copper output currently comes from just a few countries — notably Chile, Peru, China, and the Democratic Republic of Congo. This geographical dependency leaves the global supply chain vulnerable to both geopolitical tensions and environmental regulations.

Impact on Renewable Energy and EV Ambitions

The copper shortfall could have significant implications for the global push toward net-zero emissions. Every megawatt of solar power requires between 4 to 5 tons of copper, while a single wind turbine uses as much as 8 tons. Similarly, an electric vehicle uses nearly three to four times more copper than a conventional petrol car.

India, for instance, aims to achieve 500 GW of renewable energy capacity by 2030 and transition a large portion of its automotive market to electric vehicles. If copper prices surge or supply tightens, the cost of renewable energy infrastructure and EV manufacturing could rise sharply.

This, in turn, might delay some clean energy projects, making energy affordability and sustainability major policy challenges. For a fast-growing economy like India, balancing energy security with the green transition will require careful resource planning.

The Role of AI and Data Centres

A relatively newer driver of copper demand is the AI and data centre industry. Massive computing clusters, especially those powered by GPUs, require enormous amounts of electricity and efficient cooling systems — both dependent on complex power wiring, thermal systems, and backup networks built largely from copper.

India’s data centre industry, projected to reach 3 GW of capacity by 2027, is part of this global trend. Leading technology firms and cloud providers are expanding their infrastructure footprints in Mumbai, Hyderabad, and Chennai. As AI workloads multiply, copper consumption in these facilities is expected to surge by double digits annually.

The irony is clear: while AI promises to optimize industrial supply chains, including mining and energy, it simultaneously fuels copper demand, pushing the system to its limits.

Mitigation Efforts: Recycling and Substitutes

To address future shortages, countries and companies are emphasizing recycling and resource efficiency. Presently, recycled copper meets about 15–20% of global demand, but experts say that share could rise to 30% with better collection systems and advanced refining technologies.

Innovation is also under way to develop copper alternatives, such as aluminum-based conductors or graphene composites, though none match copper’s performance in conductivity and durability on a large industrial scale.

Another solution lies in urban mining — recovering copper from discarded electronics, motors, transformers, and construction scrap. With India’s growing e-waste sector, this could become an important domestic source of metal in the coming decades.

India’s Strategic Position in the Copper Story

India currently imports a significant portion of its refined copper after the shutdown of key smelting capacities in recent years. However, the country holds potential for expanding domestic refining and mining capacities, particularly in states such as Rajasthan, Madhya Pradesh, and Jharkhand.

As global prices rise, India could witness renewed investments in copper processing, recycling, and value-added manufacturing, especially in EV components, renewable infrastructure, and electronics.

Several policy experts have also urged the government to consider strategic copper reserves, similar to oil or critical mineral stocks, to protect the economy from future disruptions. Additionally, industry players are pushing for faster environmental clearances for mine expansions, smoother trade logistics, and incentives for sustainable resource use.

A Crossroads for the Global Economy

The copper shortage is more than just an industrial challenge — it represents a critical pivot point for the future of green technology, energy equity, and digital infrastructure. With every part of modern life — from smartphones to solar panels — running on copper, the stakes are higher than ever.

Experts believe that timely policy actions, joint industry-government initiatives, and global cooperation will be required to balance demand growth with sustainable supply.

If the warnings hold true, the next decade might witness a “race for copper”, mirroring earlier scrambles for oil and rare earths. The outcome will determine not only who controls the next wave of industrial growth but also how soon the world fulfills its climate commitments.

For now, the message is clear: the world’s green and digital future is wired with copper — and the clock is ticking.