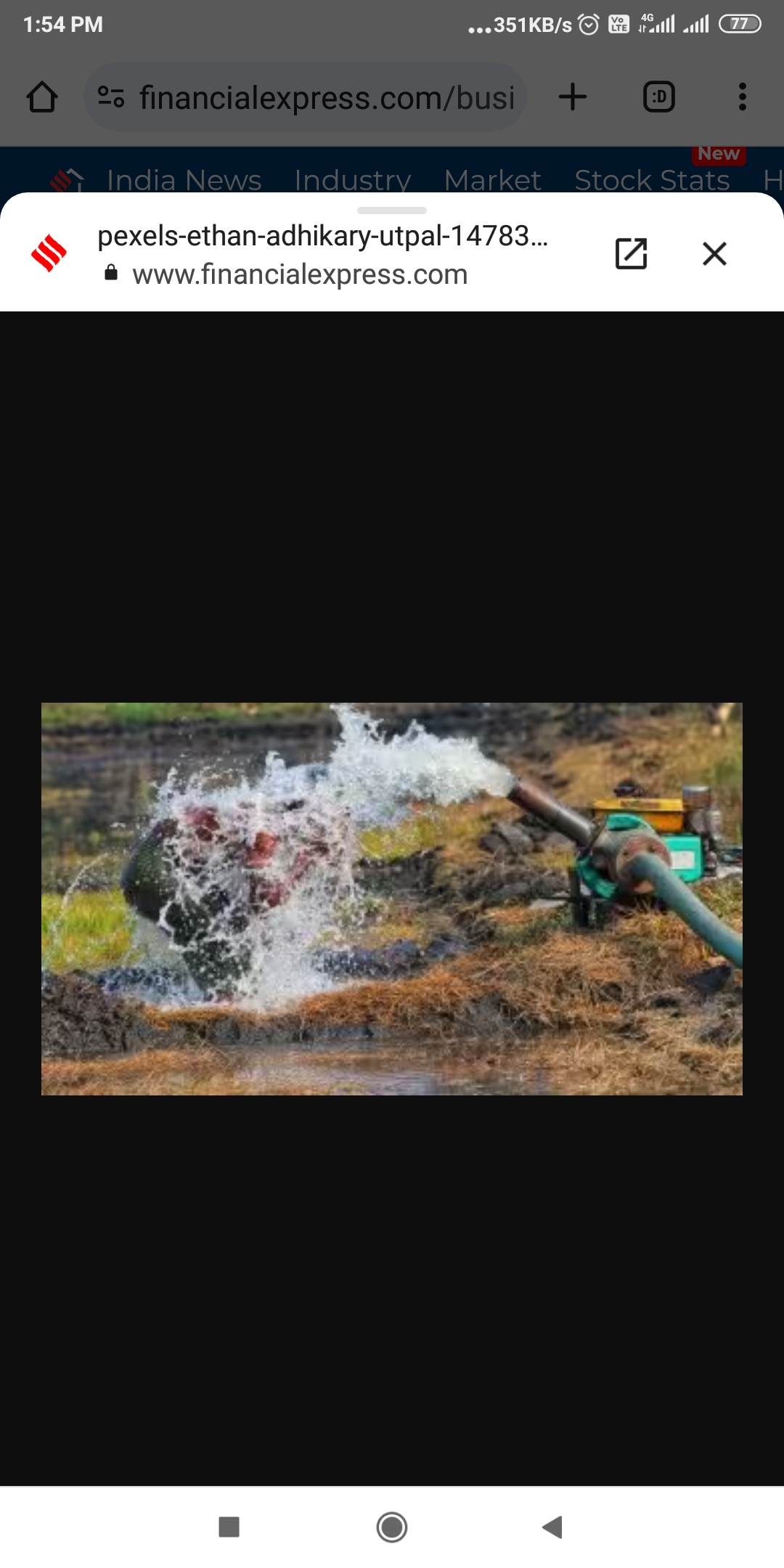

Demand for agricultural pumps is largely resilient: a “good” monsoon boosts farm income and pump purchases, supported by a good kharif harvest, while a “poor” monsoon demands asked to use a pump to irrigate rabi plants.

According to a report by CRISIL Ratings, agricultural (agricultural) pump manufacturers will witness a decent revenue growth of 7-9% in FY25. This will supported by steady domestic demand for conventional pumps and growing consumption of solar pumps, largely under the PM Kusum programme. This will follow likely revenue growth of 8 to 10 per cent in the current financial year.

Operating margins will also remain stable, at 12-13% this financial year and next, thanks to improved operating leverage and stable prices of key raw materials. This, coupled with a stable working capital cycle and moderate capital expenditure (capex), will support the credit risk profile.

CRISIL Ratings analyzed five major agricultural pump manufacturers, accounting for nearly 55% of the industry’s revenue estimated at ~Rs 6,000 crore in FY24 to publish the report. The sector is dominated by conventional pumps (grid-connected pumps and diesel pumps), which account for about 90% of the market share, with the remainder being solar pumps.

Demand for agricultural pumps is largely resilient: a “good” monsoon boosts farm income and pump purchases, supported by a good kharif harvest, while a “poor” monsoon demands asked to use a pump to irrigate rabi plants. This was also evident in the current financial year, where revenue growth was largely volume-driven, as conventional pump sales increased amid irregular monsoons caused by El Nino conditions.

“Taking into account normal monsoons in FY25, industry revenue growth will be largely driven by production. While conventional pumps may see steady growth at 6-8%, solar pump volumes will grow at a faster rate of about 20% year-on-year, supported by expected decline in pump prices,” said Anuj Sethi, Senior Director. CRISIL Rating.

Solar pumps are expected to become cheaper in FY25 as manufacturers pass on lower prices of solar modules, an important raw material, the report added. accounts for about 65-70% of the cost of a solar pump. . This, combined with increased order intake under the PM KUSUM program, is expected to close in March 2026; will be behind double-digit volume growth expectations for the next fiscal year.

Steady growth in conventional pump volumes, coupled with the prices of key raw materials – cast iron, steel and copper (accounting for about 70 to 75% of total costs), the remaining product lines will remain profitable as operating healthy at 12-13% this financial year. and the next (~12% in 2023), CRISIL Ratings said.

“Conventional pump manufacturers are operating at 65-70% capacity and solar pump manufacturers at around 40%, thereby avoiding the need for significant investment. This, coupled with healthy cash flows and a steady working capital cycle, driven by one-off receivables and moderate inventory levels, should keep the credit profile in the sector stable, ” said Aditya Jhaver, Director, CRISIL Ratings.

Debt metrics will remain strong, with interest coverage and leverage expected at 18-20 times and below 0.10 times respectively this financial year and next, better than a year. little compared to fiscal 2023. Therefore, precipitation and weather patterns are the same as geopolitical factors. Risks affecting key commodity prices will need to be monitored.

For more information, visit at https://happenrecently.com/zepto/?amp=1