India’s IPO market has seen more companies launch in the past year than China and Japan combined, but historically, most have been unprofitable.

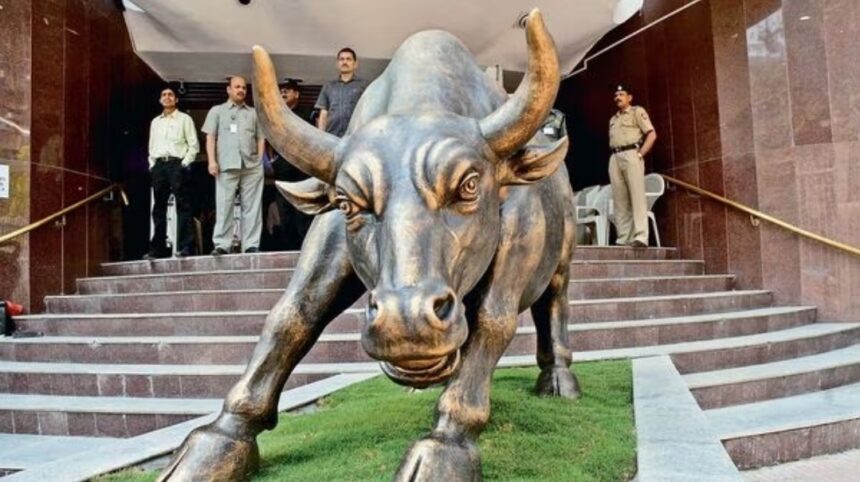

India is one of the most vibrant markets in the world for IPOs. In the past year, more businesses were established than China and Japan combined. But if history is to be believed, in the long run, most of them will turn out to be failures. However, the appeal of “pop” – a significant profit on the listing day – means this fever will not subside.

Something is seriously broken. YK2 Partners, a firm specializing in investing exclusively in the Indian public markets, has been counting on over two decades of raising initial capital by domestic companies. Analysts at YK2, based in Mumbai and London, have reviewed all 300+ motherboard issues since January 2004 over a 10-year trading history. According to their calculations, the average IPO in this group returned -3.5% per year, turning an investment of 100 rupees ($1.2) into 70 rupees a decade later. It doesn’t matter if they were registered in 2004 or 2013 or any year in between. Indian IPOs have failed miserably to generate incremental returns for investors compared to what they could have earned passively simply by holding a common benchmark. Some 77% have underperformed the NSE500 index over the 10-year period, with an average underperformance of more than 14% per year. In other words, 100 rupees uninvested for a beginner can become 280 rupees with very little effort.

“We are characterizing the IPO process as a scheme orchestrated by management,” YK2 co-founders Arun Agarwal and Vinod Nair wrote in a note accompanying their research. private equity investors, anchor investors, investment bankers, media, etc.”. “This may make sense for investors looking for an IPO, but not for long-term investors like us.”

The regulator’s responsibility is to ensure that companies with relatively strong prospects enter the public markets and offer shares at prices that create long-term wealth. The Securities and Exchange Board of India has long been aware that the domestic IPO market falls short of this ideal. However, some of the measures attempted or considered by SEBI have been controversial.

One of them is the IPO rating (similar to a bond credit rating). Made mandatory since 2007, the classification became optional in 2014 amid intense lobbying. Another idea is to allow retail investors to return shares to major shareholders at the issue price after three months of underperformance. This safety net was considered for many years and then abandoned.

However, there is still room to improve the quality of the primary capital market. Clearly, the current disclosure-based pricing regime does not meet this challenge. Just a few months ago, SEBI Chairman Madhabi Puri Buch said that the excuse companies often give to justify high IPO valuations is “nothing but a few meaningless English words”.

There may be a simple reason why verbiage can so easily be disguised as value: the average IPO generates an average listing-day gain of 25%, and India’s rich have lots of savings. Ben Bernanke, the former chairman of the Federal Reserve, has previously maintained that a “global savings glut” – a capital outflow from China and oil-producing countries – is the cause of interest gains. low yield. In India’s case, it is capital controls that place limits on how much the wealthy can invest abroad. Any excess local savings will eventually push domestic assets out, from real estate to IPOs.

Real estate transactions have a certain inertia but IPO prices reverse very quickly. This explains the average oversubscription rate of 44 times in recent years. So how do you throw sand in the wheel? The SEBI chief said on Friday that the regulator is probing investment banks that artificially inflated requests for shares to create a false impression of demand.

Cleaning up the market is a good first step but not enough. YK2’s Agarwal suggested that SEBI should consider a mandatory one-year lock-in period for all IPO investors so that subscriptions are driven by fundamentals and not pop appeal. More revelations would just mean more words. They cannot break the link between abnormal demand and opportunistic supply. Only more skins in the game are possible.

For more information, visit at https://happenrecently.com/zepto/?amp=1